July 24, 2017. Calgary Alberta: Antioquia Gold Inc. (‘Antioquia Gold” or the “Company”) (TSX-V: AGD; OTCQX: AGDXF) announces a new 3,000 meter surface drilling program and provides a Cisneros project update.

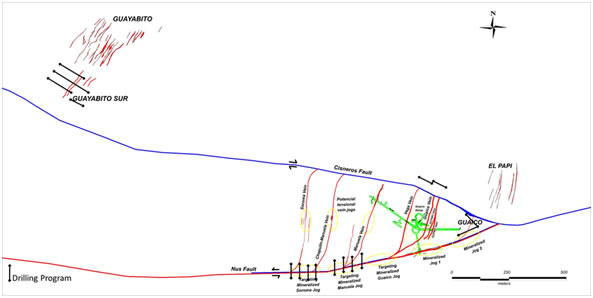

Logan Drilling SAS has been contracted for the drilling program with the goal of extending the Nus, Guayabito and Guaico vein structures and exploration of new mineralization.

The drilling program will explore the NUS structure with eight drill holes moving roughly 700 meters to the west of previous drilling, intersecting the previously defined Manuela, Soroma, and Chapulin-Manuela Veins. The Guayabito System will be explored with four drill holes. A new vein system will also be tested at Guaico near the intersection of the NUS and Cisneros faults. See Figure 1

It is anticipated the surface drilling program will commence in late July with first results by October.

Figure 1 — Proposed Surface Drilling

Underground drilling will be performed by Antioquia Gold using a Packsack Hydraulic FL-50 drilling machine with a 70m depth capability. The underground drilling will test Nus vein targets with the goal of defining the geometry and actual thickness of the Nus vein structure. The company anticipates systematic underground drilling spaced on 15-20 meter intervals above the most important veins along levels 1248, 1235 and 1160. Initial results of assays from the drilling are expected in late September.

“We have made great advances at the project and are looking forward to the upcoming surface and underground drilling to better define the vein structures and mineralization. We anticipate releasing an updated mineral resource estimate within the next month,”stated Mr. Gonzalo de Losada, President and Chief Executive Officer of Antioquia Gold. “With a focus on the updated mineral resource and new drilling we anticipate initial production may be delayed into the second quarter of 2018.” Mineral resource are not mineral reserves and do not have demonstrated economic viability.

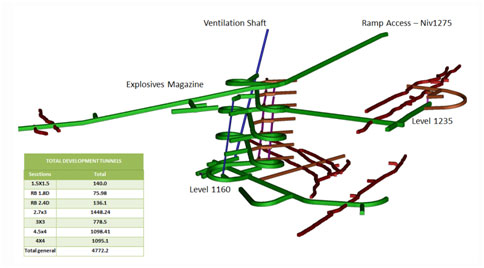

Progress at the Guiaco Mine includes the following updates. See Figure 2

- + 5000 meters of tunnel development

- 986 meters of Main Ramp developed at level 1160, 115 meters below main access

- Average of 400 meters/month of tunnel development in last six months

- A 136 meter vertical ventilation shaft has been completed and connected to the underground workings at level 1160.

- + 1500 meters of drifts on mineralized structures have been excavated.

- +5500 tonnes of mineralized material mined from drifts on structure. Mineralized material is being stockpiled pending completion of millworks.

- + 3300 geochemical channel samples taken in the underground workings.

- Purchasing main pumping and ventilation equipment to replace contractor’s equipment.

- Underground electric installation on level 1160 has been complete and energized. With a total capacity of 1.0 MVA. The Mine is connected to the national electrical grid.

Figure 2

Roger Moss, Ph.D., P.Geo, is the qualified person, as that term is defined by National Instrument 43-101, on behalf of the Company and has reviewed and approved the scientific and technical content contained in this press release.

Readers are cautioned that the Company’s decision to move forward with the construction and production of the Cisneros Mine is not based on the results of any preliminary economic assessment (“PEA”), pre-feasibility study or feasibility study of mineral resources or reserves demonstrating economic or technical viability. As such there may be an increased uncertainty of achieving any particular level of recovery of gold or the cost of such recovery, including increased risks associated with developing a commercially mineable deposit.

On behalf of the Antioquia Gold Board of Directors

Mr. Gonzalo de Losada,

President and Chief Executive Officer

Antioquia Gold Inc.

For more information please visit www.antioquiagoldinc.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Reader Advisory Forward-Looking Statements:

This press release contains “forward-looking information” within the meaning of Canadian securities legislation. This information and these statements, referred to herein as “forward-looking statements”, are made as of the date of this press release and the Company does not intend, and does not assume any obligation, to update these forward-looking statements, except as required by law.

Forward-looking statements relate to future events or future performance and reflect current expectations or beliefs regarding future events and include, but are not limited to, statements with respect to: capital expenditures, operating costs, and the anticipated project schedule. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “anticipates”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategy”, “goals”, “objectives”, “schedule” or variations thereof or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements are made based upon certain assumptions by the Company and other important factors that, if untrue, could cause the actual results, performances or achievements of Antioquia Gold to be materially different from future results, performances or achievements expressed or implied by such statements. Such statements and information are based on numerous assumptions regarding present and future business prospects and strategies and the environment in which Antioquia Gold will operate in the future, including the price of gold, anticipated costs and Antioquia Gold’s ability to achieve its goals, anticipated financial performance, regulatory developments, development plans, exploration, development and mining activities and commitments. Although management considers its assumptions on such matters to be reasonable based on information currently available to it, they may prove to be incorrect. Additional risks are described in Antioquia Gold’s most recently filed annual and interim MD&A and other disclosure documents available under the Company’s profile at: www.sedar.com.

By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and risks exist that estimates, forecasts, projections and other forward-looking statements will not be achieved or that assumptions do not reflect future experience. We caution readers not to place undue reliance on these forward-looking statements as a number of important risk factors could cause the actual outcomes to differ materially from the beliefs, plans, objectives, expectations, anticipations, estimates, assumptions and intentions expressed in such forward-looking statements.

Readers should also be cautioned that the Company’s decision to move forward with the construction and production of the Cisnero Mine is not based on the results of any preliminary economic assessment (“PEA”), pre-feasibility study or feasibility study of mineral resources demonstrating economic or technical viability. In 2013, the Company filed a technical report completed in accordance with National Instrument 43-101 (“NI 43-101”) titled “Cisneros Gold Project, Antioquia Department, Colombia” dated October 14, 2013 (the “Cisneros Report”), a copy of which is available on SEDAR under the Company’s profile at www.sedar.com. Readers are referred to section 14.13 of the Cisneros Report for details on independently verified mineral resources on the Cisneros Project. Since 2013, the Company has undertaken additional exploration and development activities; and after taking into consideration various factors, including but not limited to: the exploration and development results to date, technical information developed internally that has been reviewed and approved by Mr. Roger Moss who serves as a qualified person under the definition of National Instrument 43-101, the availability of funding, the low starting costs as estimated internally by the Company’s management, the Company is of the view that the commissioning of a PEA, the establishment of mineral reserves, the commissioning of a pre-feasibility study or feasibility study at this stage is not necessary, and that the most responsible utilization of the Company’s resources is to proceed with the development and construction of the mine. Readers are cautioned that due to the lack of a PEA, pre-feasibility study or feasibility study, there is increased uncertainty and higher risk of economic and technical failure associated with the Company’s decision. In particular, there is additional risk that mineral grades will be lower than expected, the risk that construction or ongoing mining operations will be more difficult or more expensive than management expected. Production and economic variables may vary considerably, due to the absence of a detailed economic and technical analysis in accordance with NI 43-101. Project failure may materially adversely impact the Company’s future profitability, its ability to repay existing loans, and its overall ability to continue as a going concern.