October 16, 2012, Calgary, Alberta: Antioquia Gold Inc. (“Antioquia Gold”) (TSX-V: AGD; OTCQX: AGDXF) announces that due to the current market condition, it has repriced the original financing announced on September 17, 2012 from a price of $0.17 to $0.12 per unit.

The non-brokered private placement will raise aggregate gross proceeds of up to $3,000,000 via the issuance of units (the “Units”) at $0.12 per Unit (the “Offering”). Each Unit will be comprised of one common share in the share capital of the Company (“Common Shares”) and one-half of one common share purchase warrant of the Company (“Warrants”). Each whole Warrant will entitle the holder thereof to purchase one additional Common Share at a price of $0.25 per share for a period of six (6) months from the date of issuance. The Company may pay a finder’s fee in connection with this transaction. The cash proceeds will be added to working capital and thereby used to fund the 2012 fourth quarter drilling program at Cisneros. Completion of the Offering is subject to approval from the TSX Venture Exchange.

About Antioquia Gold Inc.

Antioquia Gold has been exploring for precious metals in Colombia since 2007 and has accumulated a land package of close to 40,000 hectares located throughout Colombia. Antioquia Gold’s principal asset, which is being actively explored, is its 5,630 hectare Cisneros Project, located 55 kilometres northeast of Medellin in the Department of Antioquia, Colombia. At the Cisneros Project the Company has conducted extensive geochemical and geophysical programs over the entire property and has identified to date 11 exploration zones. On the original discovery zone it has drilled over 40,000 metres and is well versed in the understanding of the deposit type and the project’s path to resource definition and production.

On behalf of Antioquia Gold Inc.

Richard Thibault, President & CEO

For further information on Antioquia Gold Inc., visit our website at www.antioquiagoldinc.com or contact:

Investor Relations

403-457-4653

[email protected]

You can also follow Antioquia Gold on twitter: @AntioquiaAGD

To receive Company news by email, contact [email protected] and mention “Antioquia Gold” news in the subject line.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

| Drill Hole | From | To | Length (m)* | Au (g/t) | Cu (%) |

|---|---|---|---|---|---|

| GCO12-025 | 214.10 | 215.80 | 1.70 | 0.806 | |

| GCO12-026 | 132.65 | 136.15 | 3.50 | 2.082 | |

| Including | 134.80 | 136.15 | 1.35 | 4.228 | |

| GCO12-027 | 155.70 | 159.55 | 3.85 | 12.398 | |

| Including | 158.10 | 159.55 | 1.45 | 32.670 | |

| GCO12-027 | 177.85 | 180.20 | 2.35 | 6.893 | |

| Including | 177.85 | 179.20 | 1.35 | 11.910 | |

| GCO12-027 | 188.20 | 190.50 | 2.30 | 3.457 | |

| GCO12-028 | 82.90 | 85.00 | 2.10 | 2.276 | |

| GCO12-029 | 295.40 | 296.90 | 1.50 | 1.589 | |

| GCO12-029 | 343.15 | 349.75 | 6.60 | 10.837 | |

| Including | 343.15 | 344.35 | 1.20 | 10.982 | |

| Including | 347.50 | 349.25 | 1.75 | 33.229 | |

| Including | 348.40 | 349.25 | 0.85 | 2.260 | |

| GCO12-029 | 455.10 | 472.10 | 17.00 | 0.348 | |

| Including | 467.05 | 468.60 | 1.55 | 2.463 | |

| GCO12-029 | 455.10 | 484.10 | 29.00 | 0.349 | |

| Including | 479.90 | 482.20 | 2.30 | 1.578 | |

| GCO12-030 | 32.95 | 35.35 | 2.40 | 7.002 | |

| Including | 32.95 | 34.80 | 1.85 | 9.074 | |

| GCO12-031 | 180.25 | 181.60 | 1.35 | 0.423 |

Note: * Intervals reported are drilled thickness and may not represent true width.

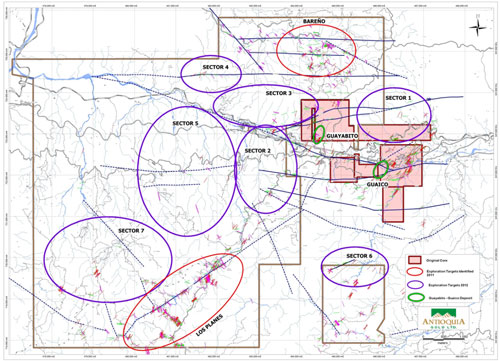

Phase 2 drilling commenced on June 26, 2012 with 4,393.4 metres of drilling completed at the Guaico deposit.

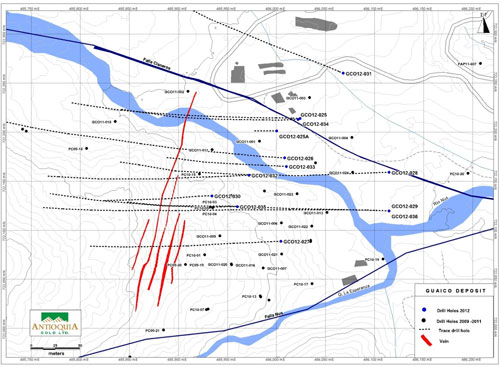

Drilling during 2012 at the Guaico deposit has been successful in further delineating the various structures comprising the Guaico deposit and all mineralized structures defined remain open to depth and along strike. Drill hole GCO12-031 intersected anomalous gold north of the Cisneros Fault suggesting that the Guaico mineralized system continues north of this fault. Furthermore, the company is also extremely encouraged by the presence of a broad Au+Ag+Cu mineralized system intersected at depth in GCO12-029. This zone, defined by 0.348 g/t Au over 17.0 metres and 0.349% Cu over 29.0 metres (plus significant Ag), is suggestive of a separate mineralized system occurring at Guaico, the significance of which remains to be defined by drilling.

Phase 3 of the 2012 drilling program is currently ongoing with 4 holes totaling 2,000 metres at the Guayabito deposit; these holes are to follow-up on successes from earlier this year (refer to press release of August 8, 2012). Once these holes have been completed in early October 2012, the drilling program will be suspended until January 2013. This will allow all results to be compiled, the geological model to be modified and an NI 43-101 resource report prepared.

We refer readers to the March 12, 2012, August 8, 2012 and September 11, 2012 News Releases for further information regarding the 2012 drill program and Cisneros Project.

“The occurrence of high-grade gold mineralization at depth and anomalous gold mineralization north of the Cisneros Fault is extremely encouraging at Guaico. The deep mineralization immediately increases the size of the Guaico deposit. Mineralization occurring along strike and north of the Cisneros Fault suggests additional drilling at Guaico could increase deposit size along strike as well”, comments Ian Fraser, Chief Geologist for Antioquia Gold.

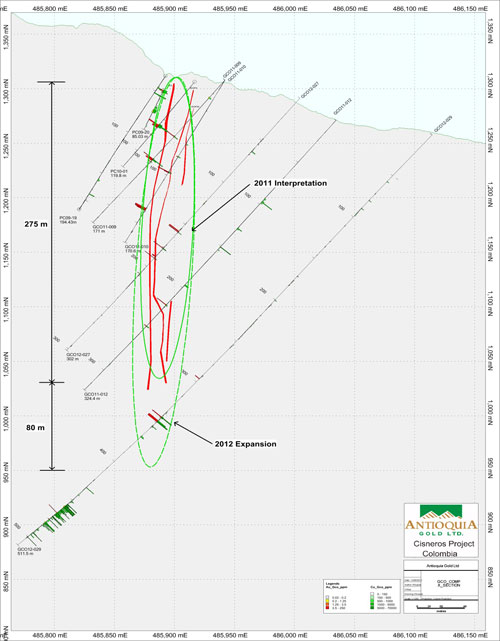

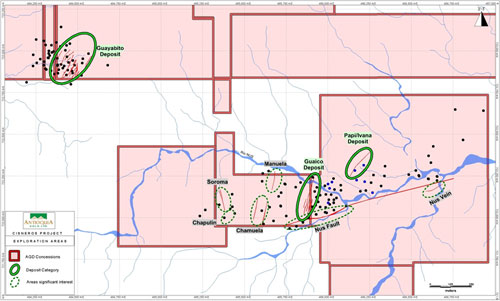

Regional exploration of 9 identified targets at the Cisneros project continues in order to define drill targets to be tested in 2013. Field work is comprised of geological mapping, prospecting and soil geochemical profiles. The Cisneros property regional exploration program is an integral part of Antioquia Gold’s future as it is designed to confirm the potential and the extent of multiple gold occurrences on the Cisneros property.

About Antioquia Gold Inc.

Antioquia Gold has been exploring for precious metals in Colombia since 2007 and has accumulated a land package of close to 40,000 hectares located throughout Colombia. Antioquia Gold’s principal asset, which is being actively explored, is its 5,630 hectare Cisneros Project, located 55 kilometres northeast of Medellin in the Department of Antioquia, Colombia. At the Cisneros Project the Company has conducted extensive geochemical and geophysical programs over the entire property and has identified to date eleven (11) exploration zones. On the original discovery zone it has drilled over 43,000 metres and is well versed in the understanding of the deposit type and the project’s path to resource definition and production.

To ensure reliable sample results Antioquia Gold has a rigorous QA/QC program in place that monitors the chain of custody of the samples and includes the insertion of blanks, preparation duplicates, field duplicates, and certified reference standards in each batch of samples. Core is photographed and sawed in half with one half retained in a secured facility for future reference if needed. Sample preparation (crushing and pulverizing) is performed at ACME laboratories in Medellin, Colombia.

Samples prepared by ACME (Medellin) are direct shipped to ACME Laboratories in Vancouver Canada, an ISO certified laboratory for analysis. Assay for gold (36 elements) is performed initially by 1Dx30g Agua Regia Digestion. Au values > 100,000 ppb are automatically checked by Gravimetric finish and Antioquia Gold further checks all assay values =10,000 ppb by Metallic Assay. Furthermore, as part of the QA/QC program, Antioquia Gold has sent to SGS laboratory in Medellin Colombia batches of pulp samples for check Fire Assay’s.

This press release has been prepared under the supervision of Ian Fraser, P. Geol., Chief Geologist for Antioquia Gold Inc. and a Qualified Person as defined by National Instrument 43-101.

On behalf of Antioquia Gold Inc.

Richard Thibault, President & CEO

For further information on Antioquia Gold Inc., visit our website at www.antioquiagoldinc.com or contact:

Investor Relations Manager

403-457-4653

[email protected]

You can also follow Antioquia Gold on twitter: @AntioquiaAGD

To receive Company news by email, contact [email protected] and mention “Antioquia Gold” news in the subject line.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements:

This news release may contain certain forward-looking information. All statements included herein, other than statements of historical fact, including, but not limited to, statements about the nine additional regional exploration zones adding significant exploration potential to the overall property, the Company’s plans for exploration in 2012, including the plans for the remaining 2,000 metres of drilling, are forward-looking statements. Forward-looking statements are based on management’s assumptions and are subject to risks and uncertainties. There can be no assurance that any forward-looking statement will prove to be accurate, and actual results and future events could differ materially from those anticipated in such information due to a number of factors beyond the Company’s control. These assumptions, risks and uncertainties include, among other things, management’s assumptions about government permitting, equipment procurement and the availability of the necessary consultants and capital, as well as the risks of delay in any of these activities and the risks inherent in Antioquia Gold’s operations, including the risks that the Company may not find any minerals in commercially feasible quantity or raise enough money to fund its exploration plans. These and other risks are described in the Company’s Annual Information Form and other public disclosure documents filed on the SEDAR website maintained by the Canadian Securities Administrators. The Company does not undertake to update any forward-looking information except as may be required by applicable securities laws.

Figure 1 – Guaico Deposit – Plan View. Year 2012 Drilling Sites.

Figure 2 – Guaico Composite Section with the year 2011 and 2012 Depth Interpretation.

Figure 3 – Cisneros Project – Original Core. Location of Deposits & Known Structures.

Figure 4 – Cisneros Project Regional Exploration Targets for 2012.