CALGARY, ALBERTA – (November 8, 2019) – Antioquia Gold Inc. (TSXV: AGD) (OTC Pink: AGDXF) (“Antioquia Gold” or the “Company”) is pleased to provide a production update for its Cisneros mining operation and announces an underground drilling program.

During the last three months of operation, the Company maintained processing rates higher than 500 dry tonnes per day with a slight decrease in the feed grade. Currently the Company’s production is mainly from the Nus shear zone with limited contribution of narrow veins.

A summary of the monthly production from the beginning of the operation highlighting the high recovery rates achieved in the process is given in the table below.

|

|

January |

February |

March |

April |

May |

June |

July |

August |

September |

October |

Mineral Processed |

Dry Tonnes |

1656 |

9666 |

11891 |

15027 |

16028 |

16474 |

17438 |

16958 |

15585 |

16052 |

Feed Grade |

g/t Au |

2.30 |

2.16 |

2.90 |

2.80 |

2.74 |

2.54 |

2.88 |

2.33 |

2.02 |

2.03 |

Gold Produced |

Oz |

112 |

598 |

1044 |

1292 |

1354 |

1246 |

1524 |

1223 |

958 |

993 |

Total Recovery |

% |

91.7% |

89.2% |

94.2% |

95.6% |

96.0% |

92.7% |

94.3% |

96.3% |

94.5% |

95% |

Average |

Dry |

151 |

345 |

384 |

501 |

517 |

549 |

563 |

547 |

520 |

518 |

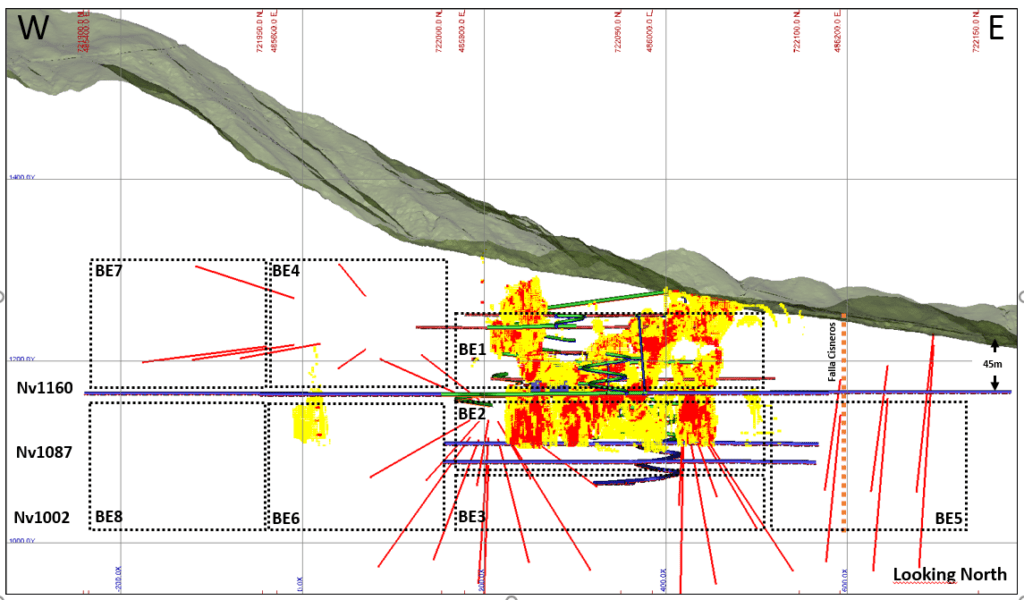

The company plans to start an underground drilling program before the end of the year with the aim of expanding the mineral resources to extend the mine life., A significant increase in mining rates is expected due to the upcoming expansion of the processing plant and the implementation of the ore sorting process (see News Release dated August 15, 2019).

The drilling program will be at least 10,300 meters and will be focused mainly on exploring the Nus shear zone and the Guayabito vein system along strike and at depth (See figure below).

Significant progress on the six strategic fronts that are in development (see August 15, 2019 News Release) includes:

- Plant Expansion to 1200 TPD: While construction progress is on schedule, delivery of the second mill is delayed for 4 weeks, so the completion date has been redefined for February 2020. Progress is also being made with the environmental impact assessment, which is expected to be delivered to the authorities before year end.

- New mining contractor: The new mining contractor is mobilizing its equipment and contracting personnel to site with the objective of starting operations in December.

- Alternative mining pilot tests in narrow veins: Pilot mining tests in narrow veins continue with productivity, cost and quality (dilution) being investigated. The evaluation is expected before the end of the last quarter of 2019.

- Installation of the ore sorting process: The companies that will perform the mechanical assembly, construction and electrical instrumentation have been selected. The process should be operational before the end of the first quarter of 2020.

- Energy purchase contract signed: The contract with EPM (Empresas Publicas de Medellin) has been signed, therefore a reduction of rates will be reflected in the month of November.

- Purchase of Third-Party Mineral feed: Due diligence studies are in progress with potential mineral suppliers. Some minor purchases have been made, with satisfactory results for the most part.

“With all these advances in the different strategic lines defined by the company, financial results have been improving, achieving positive EBITDA in the last few months. These results are expected to improve further with the improvements and projects that are to come and debt repayment is expected to start next year”. Says Mr. Gonzalo de Losada, president and CEO of the company.

Readers should also be cautioned that the Corporation’s decision to move forward with the construction and production of the Cisneros Mine is not based on the results of any pre-feasibility study or feasibility study of mineral resources demonstrating economic or technical viability. Readers are referred to the Cisneros Report for details on independently verified mineral resources on the Cisneros Project. Since 2013, the Corporation has undertaken exploration and development activities; and after taking into consideration various factors, including but not limited to: the exploration and development results to date, technical information developed internally, the availability of funding, the low starting costs as estimated internally by the Corporation’s management, the Corporation is of the view that the establishment of mineral reserves, the commissioning of a pre-feasibility study or feasibility study at this stage is not necessary, and that the most responsible utilization of the Corporation’s resources is to proceed with the development and construction of the mine. Readers are cautioned that due to the lack of pre-feasibility study or feasibility study, there is increased uncertainty and higher risk of economic and technical failure associated with the Corporation’s decision. In particular, there is additional risk that mineral grades will be lower than expected, the risk that construction or ongoing mining operations will be more difficult or more expensive than management expected. Production and economic variables may vary considerably, due to the absence of a detailed economic and technical analysis in accordance with NI 43-101. Project failure may materially adversely impact the Corporation’s future profitability, its ability to repay existing loans, and its overall ability to continue as a going concern.

Qualified Persons

Roger Moss, Ph.D., P.Geo., Consultant to Antioquia Gold, is the qualified person as defined by National Instrument 43-101 and has reviewed and approved the technical information provided in this news release.

For further information contact:

Antioquia Gold Inc.

Tel: 1-800-348-9657 (Canad�)

Email: [email protected]

www.antioquiagold.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

Reader Advisory Forward-Looking Statements:

This press release contains “forward-looking information” within the meaning of Canadian securities legislation. This information and these statements, referred to herein as “forward-looking statements”, are made as of the date of this press release and the Corporation does not intend, and does not assume any obligation, to update these forward-looking statements, except as required by law.

Forward-looking statements relate to future events or future performance and reflect current expectations or beliefs regarding future events and include, but are not limited to, statements with respect to: the completion of the Rights Offering and the use of proceeds of the offering. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “anticipates”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategy”, “goals”, “objectives”, “schedule” or variations thereof or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements are made based upon certain assumptions by the Corporation and other important factors that, if untrue, could cause the actual results, performances or achievements of Antioquia to be materially different from future results, performances or achievements expressed or implied by such statements. Such statements and information are based on numerous assumptions regarding present and future business prospects and strategies and the environment in which Antioquia will operate in the future, including the accuracy of any resource estimations, the price of gold, anticipated costs and Antioquia’s ability to achieve its goals, anticipated financial performance, regulatory developments, development plans, exploration, development and mining activities and commitments. Although management considers its assumptions on such matters to be reasonable based on information currently available to it, they may prove to be incorrect. Additional risks are described in Antioquia’s most recently filed Annual Information Form, annual and interim MD&A and other disclosure documents available under the Corporation’s profile at: www.sedar.com.

By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and risks exist that estimates, forecasts, projections and other forward-looking statements will not be achieved or that assumptions do not reflect future experience. We caution readers not to place undue reliance on these forward-looking statements as a number of important risk factors could cause the actual outcomes to differ materially from the beliefs, plans, objectives, expectations, anticipations, estimates, assumptions and intentions expressed in such forward-looking statements.