Antioquia Gold Cisneros Mineral Resource Estimate Update

Calgary, Alberta–(Newsfile Corp. – November 2, 2022) – Antioquia Gold Inc. (TSXV: AGD) (OTC Pink: AGDXF) (“Antioquia Gold” or the “Corporation”) is pleased to announce a mineral resource estimate update for its Cisneros mining operation.

Mine Technical Services (MTS) audited the Cisneros Mineral Resource estimate and completed an independent mineral resource estimate for validation purposes. Differences were generally less than 10% in tonnes, grade and contained metal.

Mineral Resources for the project were classified under the 2014 CIM Definition Standards for Mineral Resources and Mineral Reserves by applying a cut-off grade that incorporated mining costs, process operating costs, metallurgical recovery parameters and commodity prices.

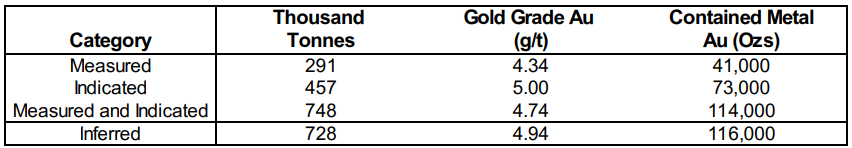

The Qualified Person for the Mineral Resource estimate is David G. Thomas, P.Geo of MTS. Mineral resources are reported using a long-term metal price of $1,800/troy oz USD. Variable marginal cut-off grades were applied depending on the anticipated mining method. Resources have an effective date of October 1, 2022. A summary of the Mineral Resource estimate is shown in Table 1. The Mineral Resources are shown by mining area in Table 2, Table 3 and Table 4.

Table 1: Summary Cisneros Project Mineral Resource Estimate David Thomas, P. Geo. (Effective Date: October 1, 2022)

- Domains were modelled in 3D to separate mineralized rock types from surrounding waste rock. The domains were modelled based on quartz veining and structural interpretations of the vein geometries. At Nus and the massive bodies at Guayabito, a probability assisted constrained kriging (PACK) method was used to further constrain block grade estimates.

- For the Nus shear, rawdrill hole assays were composited to 2.0 m lengths broken at domain boundaries. In the Guaico and Guayabito vein models, assays were composited to a maximum length of 1 m with shorter length composites where the veins are less than 1 m in width.

- Indicator correlations and indicator variography were used to define high-grade outlier thresholds and distance restrictions to prevent over-projection of higher-grades into lower-grade areas.

- Dry bulk density was estimated directly from SG measurements by inverse distance cubed where data were available. A dry bulk density of 2.75 g/cm3 was applied in unestimated areas and in veins with no SG measurements.

- MTS classified blocks to the Measured category using multiple levels of mine development generally spaced less than 15 m apart and in areas with grade continuity above the Mineral Resource cut-off grade. Indicated category blocks were classified in areas with multiple levels of mine development spaced more than 15 m apart or with drilling less than 25 m apart. Inferred mineral resources were classified in areas with a single mine development level and drilling spaced less than 50 m apart.

- The QP determined that the material has reasonable prospects of economic extraction by application of a cut-off grade which considers process/G&A, mining costs and by constraining the Mineral Resource estimate to areas in proximity to mine development, by removing isolated blocks and by assuming a 30 m crown pillar belowsurface topograhpy. In addition, Mineral Resources within veins are reported above a grade-thickness constraint to ensure that material is above cut-off over an assumed minimum mining width of 1 m.

- A metal price of $1,800/ozwas used for gold. A metallurgical recovery of 94%for gold was applied together with a smelter payable of 97%and a 3.2%government royalty. Gold cut-off grades of 1.6 g/t (Nus shear), 2.29 g/t (Guaico veins) and 1.82 g/t (Guayabito veins) were estimated by MTS based on a total process and G&A operating cost of $33.0 /t of ore mined. Mining costs were $48/t (Nus shear), $84/t (Guaico veins) and $60/t (Guayabito veins). Antioquia Gold chose cut-off grades of 1.5 g/t (Nus shear), 2.3 g/t (Guaico veins) and 1.8 g/t (Guayabito veins).

- The contained gold figures shown are in situ. No assurance can be given that the estimated quantities will be produced. All figures have been rounded to reflect accuracy and to comply with securities regulatory requirements. Summations within the tables may not agree due to rounding.

- Mineral Resources, which are not Mineral Reserves, do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

- The quantity and grade of reported Inferred resources in this estimation are conceptual in nature and there has been insufficient exploration to define these Inferred resources as an Indicated or Measured Mineral Resource. There is a reasonable expectation that the majority of the Inferred Mineral Resource can be upgraded to Indicated with continued exploration.

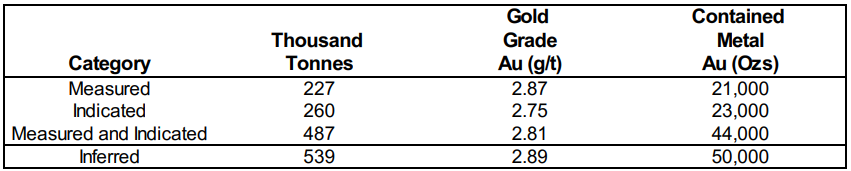

Table 2: Nus Shear Mineral Resource Estimate (1.5 g/t Au cut-off Grade)

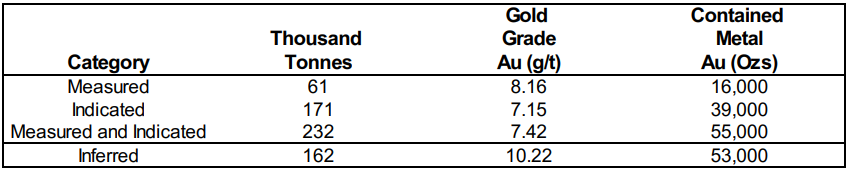

Table 3: Guaico Veins Mineral Resource Estimate (2.3 gram meters Au cut-off)

Table 4: Guayabito Veins and Massive Body Mineral Resource Estimate (1.8 gram meters Au cut-off for veins and 1.8 g/t for Massive Bodies)

The updated MRE for Cisneros has been completed according to CIM Definition Standards and will be supported by a NI 43-101 independent report which will be published and filed on the Company’s website and SEDAR profile within 45 days of the publication of this press release.

Readers should be cautioned that the Corporation’s decision to move forward with the construction and production of the Cisneros Mine is not based on the results of any pre-feasibility study or feasibility study of mineral resources demonstrating economic or technical viability. Readers are referred to the Cisneros Report for details on independently verified mineral resources on the Cisneros Project. Since 2013, the Corporation has undertaken exploration and development activities; and after taking into consideration

various factors, including but not limited to: the exploration and development results to date, technical information developed internally, the availability of funding, the low starting costs as estimated internally by the Corporation’s management, the Corporation is of the view that the establishment of mineral reserves, the commissioning of a pre-feasibility study or feasibility study at this stage is not necessary, and that the most responsible utilization of the Corporation’s resources is to proceed with the development and construction of the mine. Readers are cautioned that due to the lack of pre-feasibility study or feasibility study, there is increased uncertainty and higher risk of economic and technical failure associated with the Corporation’s decision. In particular, there is additional risk that mineral grades will be lower than expected, the risk that construction or ongoing mining operations will be more difficult or more expensive than management expected. Production and economic variables may vary considerably, due to the absence of a detailed economic and technical analysis in accordance with NI 43-101. Project failure may materially adversely impact the Corporation’s future profitability, its ability to

repay existing loans, and its overall ability to continue as a going concern.

Qualified Persons

David G. Thomas, P.Geo., Consultant to and independent from Antioquia Gold, is the qualified person as defined by National Instrument 43-101 and has reviewed and approved the technical information provided in this news release.

For further information on Antioquia Gold Inc. contact:

Gonzalo de Losada – CEO

Thomas Kelly – Director

Antioquia Gold Inc.

Email: [email protected]

www.antioquiagoldinc.com

Phone 57 604 6041948

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

Reader Advisory Forward-Looking Statements:

This press release contains “forward-looking information” within the meaning of Canadian securities legislation. This information and these statements, referred to herein as “forward-looking statements”, are made as of the date of this press release and the Corporation does not intend, and does not assume any obligation, to update these forward-looking statements, except as required by law

Forward-looking statements relate to future events or future performance and reflect current expectations or beliefs regarding future events and include, but are not limited to, statements with respect to: the completion of the Rights Offering and the use of proceeds of the offering. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “anticipates”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategy”, “goals”, “objectives”, “schedule” or variations thereof or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and

may be forward-looking statements.

Forward-looking statements are made based upon certain assumptions by the Corporation and other important factors that, if untrue, could cause the actual results, performances or achievements of Antioquia to be materially different from future results, performances or achievements expressed or implied by such statements. Such statements and information are based on numerous assumptions regarding present and future business prospects and strategies and the environment in which Antioquia will operate in the future, including the accuracy of any resource estimations, the price of gold, anticipated costs and Antioquia’s ability to achieve its goals, anticipated financial performance, regulatory developments, development plans, exploration, development and mining activities and commitments. Although management considers its assumptions on such matters to be reasonable based on information currently available to it, they may prove to be incorrect. Additional risks are described in Antioquia’s most recently filed Annual Information Form, annual and interim MD&A and other disclosure documents available under the Corporation’s profile at: www.sedar.com.

By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and risks exist that estimates, forecasts, projections and other forward-looking statements will not be achieved or that assumptions do not reflect future experience. We caution readers not to place undue reliance on these forward-looking statements as a number of important risk factors could cause the actual outcomes to differ materially from the beliefs, plans, objectives, expectations, anticipations, estimates, assumptions and intentions expressed in such forward-looking statements.

To view the source version of this press release, please visit

https://www.newsfilecorp.com/release/142831