CALGARY, ALBERTA – (August 22, 2018) – Antioquia Gold Inc. (“Antioquia Gold” or the “Corporation“) (TSX VENTURE: AGD) (OTCQX: AGDXF) is pleased to announce that it has reached a binding agreement with Gramalote Colombia Limited (“GCL”) whereby the Corporation will acquire from GCL 5,245 hectares comprising the “Guadualejo” property for the sum of US$ 685,000 to be paid from cash on hand.

The agreement was signed on August 15th, 2018 and Antioquia Gold acquired one hundred percent (100%) of the rights to the Mining Concession Contract number 6195, as well as the obligations arising thereof. The change of ownership of the Concession must still be registered with the government authorities.

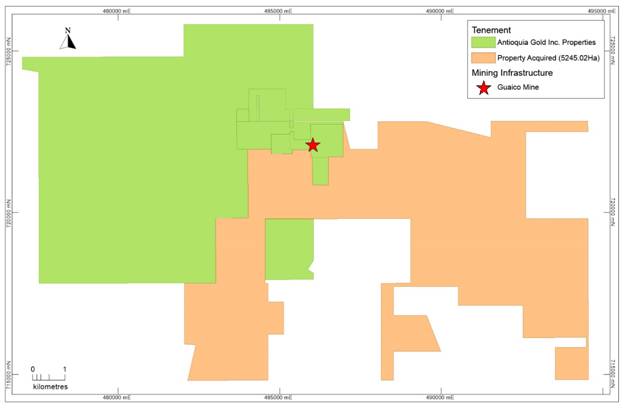

The area is located immediately adjacent to the south and east of the mining concessions where the Guaico Mine of the Cisneros Project is being developed, and has the potential to provide continuity of the main mineralized structures of Nus and the tension veins of the Guaico system. See Figure 1 below.

Some exploration activities were undertaken on the property by GCL, including geological mapping, soil sampling, geophysics and diamond drilling as described below:

- 72 samples of stream sediments

- 588 soil samples

- 1,212 rock samples

- 1,028 meters drilled

- 59 km2 airbone geophysics

Roger Moss, Ph.D., P.Geo, the Company’s Qualified Person, has verified the data contained in this news release. The verification was done by visual examination of the Company’s database and comparison with the numbers and assays presented herein. No inaccuracies were found during the verification procedure.

Upon the completion of initial exploration activities, anomalous values were identified in the soils and rocks. Follow up diamond drilling confirmed the existence of mineralized structures with prospective grade. Highlights of these results are presented in Tables 1, 2 and 3 below.

Table 1. Highlights of Rock Sampling Results

| Sample Number | Easting | Northing | Gold Grade (g/t) |

|---|---|---|---|

| 113548 | 486913 | 721208 | 11.6 |

| 12077931 | 485720 | 721237 | 12.4 |

| 2018402 | 484390 | 722800 | 13.2 |

| 12077932 | 485720 | 721237 | 14.4 |

| 113741 | 486851 | 721021 | 15.6 |

| 12017687 | 486905 | 721199 | 17.4 |

| 113602 | 486918 | 721162 | 18.2 |

| 113126 | 487031 | 721176 | 21.4 |

| 12061201 | 490977 | 717524 | 22.1 |

| 113122 | 487010 | 721188 | 22.8 |

| 113672 | 486942 | 721141 | 23.8 |

| 113673 | 486942 | 721141 | 26.4 |

| 12077934 | 485685 | 722285 | 26.6 |

| 12023346 | 486960 | 721221 | 30.4 |

| 113458 | 486894 | 720797 | 41.7 |

| 12017688 | 487018 | 721182 | 43.1 |

| 113038 | 486955 | 721202 | 60.7 |

| 12017684 | 486889 | 721181 | 116.5 |

| 12017686 | 486889 | 721181 | 159.0 |

| 12017678 | 486889 | 721181 | 161.0 |

Note: All rock samples are grab samples. Grab samples are selected samples and are not representative of the mineralization hosted on the property.

Table 2. Diamond Drill Results

| Hole code | From (m) | To (m) | Length (m)* | Sample Number | Gold Grade (g/t) |

|---|---|---|---|---|---|

| GD-DD-004 | 18 | 20 | 2 | 10178996 | 4.57 |

| GD-DD-004 | 32 | 34 | 2 | 10213504 | 2.54 |

| GD-DD-005 | 93 | 93.3 | 0.3 | 10213689 | 49.4 |

| GD-DD-005 | 139.4 | 141 | 1.6 | 10213723 | 3.24 |

| GD-DD-005 | 141 | 143 | 2 | 10213724 | 11.00 |

According to reports by GCL, the mineralized structures found resemble other mineralized structures currently under development within the operations of the Cisneros project. The structures consist of veins, veinlet and shear zones, filled with quartz, sulfides, carbonates, sericite, chlorite, among others, with variable thicknesses ranging from a few centimeters to 2 meters.

With this acquisition, Antioquia Gold consolidates the properties adjacent to its Cisneros project and extends the areas with potential mineral resources. Future detailed exploration will be carried out in the acquired area in order to seek to expand the inventory of resources and extend the life of the operations carried out at the Cisneros project.

QA/QC procedures and protocols

During the drilling campaign samples were collected, logged (geological & geotechnical), cut and sampled at GCL’s drilling camp in the project area. All quality control (“QC”) samples were introduced before shipment to ALS Minerals’ sample preparation facilities in Medellin, Colombia. The prepared samples were then shipped to ALS Minerals’ analytical facilities in Lima, Peru for analyses. Gold was fire-assayed using a 50 gram aliquot sample and Atomic Absorption finish. Multi-element analysis is achieved by Four Acid Digestion and an Induced Coupled Plasma- Emission Spectroscopy finish.

GCL’s QA/QC program included the regular insertion of blanks, multiple certified assay standards and duplicate samples into the sample shipments. These QC samples were inserted in every assay batch with each batch comprising 12% of such samples. Monitoring of these QC samples is a critical part of GCL’s QA/QC protocols that involve the re-analysis of a minimum of 10 samples bounding any failed control sample. A third party check laboratory receives 5% of all samples to verify the original assays.

Qualified Persons

Roger Moss, Ph.D., P.Geo., Consultant to Antioquia Gold, is the qualified person as defined by National Instrument 43-101 and has reviewed and approved the technical information provided in this news release.

________________________________________

For further information on Antioquia Gold Inc. contact:

Antioquia Gold Inc.

1-800-348-9657

www.antioquiagoldinc.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

Reader Advisory Forward-Looking Statements:

This press release contains “forward-looking information” within the meaning of Canadian securities legislation. This information and these statements, referred to herein as “forward-looking statements”, are made as of the date of this press release and the Corporation does not intend, and does not assume any obligation, to update these forward-looking statements, except as required by law.

Forward-looking statements relate to future events or future performance and reflect current expectations or beliefs regarding future events and include, but are not limited to, statements with respect to: the completion of the Rights Offering and the use of proceeds of the offering. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “anticipates”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategy”, “goals”, “objectives”, “schedule” or variations thereof or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements are made based upon certain assumptions by the Corporation and other important factors that, if untrue, could cause the actual results, performances or achievements of Antioquia to be materially different from future results, performances or achievements expressed or implied by such statements. Such statements and information are based on numerous assumptions regarding present and future business prospects and strategies and the environment in which Antioquia will operate in the future, including the accuracy of any resource estimations, the price of gold, anticipated costs and Antioquia’s ability to achieve its goals, anticipated financial performance, regulatory developments, development plans, exploration, development and mining activities and commitments. Although management considers its assumptions on such matters to be reasonable based on information currently available to it, they may prove to be incorrect. Additional risks are described in Antioquia’s most recently filed Annual Information Form, annual and interim MD&A and other disclosure documents available under the Corporation’s profile at: www.sedar.com.

By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and risks exist that estimates, forecasts, projections and other forward-looking statements will not be achieved or that assumptions do not reflect future experience. We caution readers not to place undue reliance on these forward-looking statements as a number of important risk factors could cause the actual outcomes to differ materially from the beliefs, plans, objectives, expectations, anticipations, estimates, assumptions and intentions expressed in such forward-looking statements.

Readers should also be cautioned that the Corporation’s decision to move forward with the construction and production of the Cisneros Mine is not based on the results of any pre-feasibility study or feasibility study of mineral resources demonstrating economic or technical viability. Readers are referred to the Cisneros Report (News Release November 20, 2018) for details on independently verified mineral resources on the Cisneros Project. Since 2013, the Corporation has undertaken exploration and development activities; and after taking into consideration various factors, including but not limited to: the exploration and development results to date, technical information developed internally, the availability of funding, the low starting costs as estimated internally by the Corporation’s management, the Corporation is of the view that the establishment of mineral reserves, the commissioning of a pre-feasibility study or feasibility study at this stage is not necessary, and that the most responsible utilization of the Corporation’s resources is to proceed with the development and construction of the mine. Readers are cautioned that due to the lack of a pre-feasibility study or feasibility study, there is increased uncertainty and higher risk of economic and technical failure associated with the Corporation’s decision. In particular, there is additional risk that mineral grades will be lower than expected, the risk that construction or ongoing mining operations will be more difficult or more expensive than management expected. Production and economic variables may vary considerably, due to the absence of a detailed economic and technical analysis in accordance with NI 43-101. Project failure may materially adversely impact the Corporation’s future profitability, its ability to repay existing loans, and its overall ability to continue as a going concern.